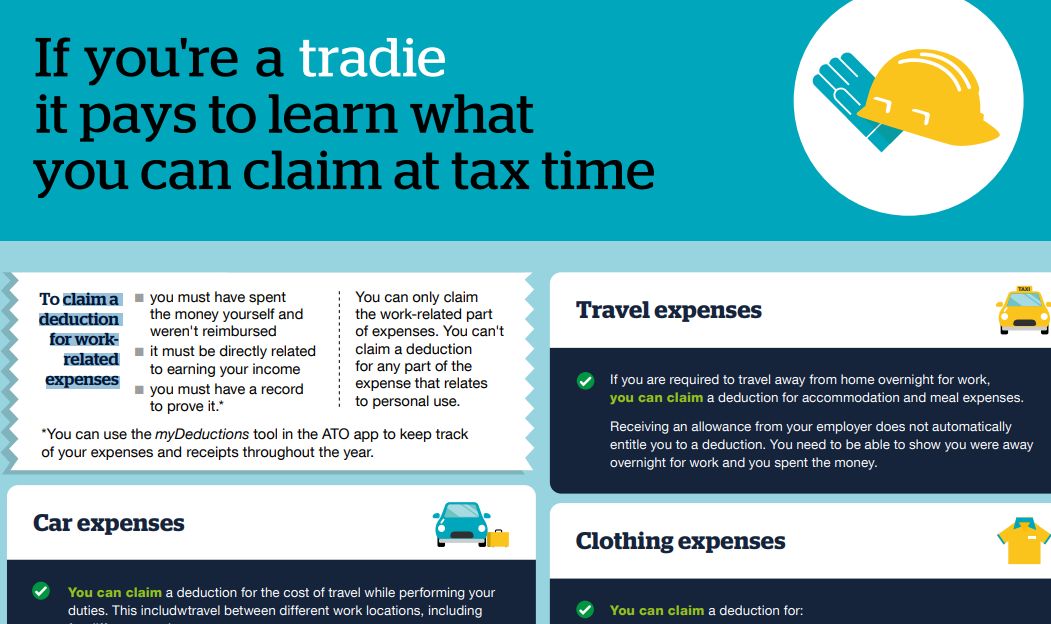

As a Tradie you are entitled to claim a range of expenses from clothing and laundry to tools and equipment.

What you can claim depends on whether you're an employee tradie or a small business (sole trader, partnership, company or trust).

Download a summary from the ATO on What Tradies can claim for work related expenses.

Download ATO's What Tradies Can Claim

Visit the ATO's page on What Small Business can claim for work related expenses.

Visit ATO's Page What Small Business Can Claim

If you would like advise or help from a friendly professional accountant with:-

- Completing your tax return and claiming your deductions.

- Quarterly Business Activity Statement lodgement.

- Choosing the correct PAYG Instalment method on your BAS.

- Income and Tax estimates in May or June, so you can make decisions prior to 30 June to minimize your tax liability and understand what is payable and when.

- Business Planning

- Setting up a Tradie Business

Phone Steve for a friendly no obligation chat about your requirements.

- Approachable and available.

- The only dumb question is the one you don’t ask.

Steve Hamilton Chartered Accountant

Looking after clients in Joondalup and the Northern Suburbs of Perth for over 20 years.Professional accounting expertise, competitive pricing & exceptional service

Find out if Steve Hamilton Chartered Accountant is right for you!

Phone Steve

Men & Women who work in a trade such as tilers, builders, gardeners, plumbers, electricians etc, often work long hours and have deadline stresses, you don't have time or energy to think about what you can claim on your tax. That's why we are here to help ensure you get the best advise, to back up your business and provide the advise and expertise on business accounts, planning & tax.